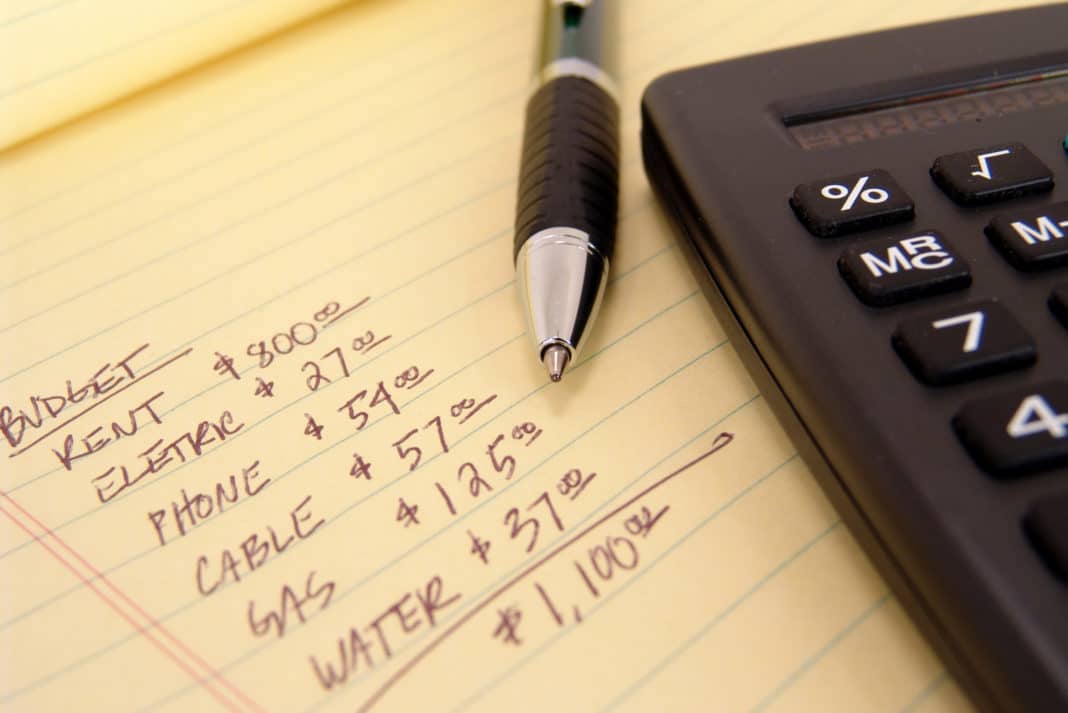

Many working adults may not closely monitor their daily expenses. It’s not a negative thing as we all have busy lives. However, it’s beneficial to comb through your finances occasionally to spot any unnecessary spending. By identifying and cutting expenses that are not essential, you can save some extra cash.

Most banks offer online platforms where you can access detailed statements for your accounts. Checking your checking and savings accounts, as well as credit card statements, online can provide more comprehensive information compared to paper statements. It’s advisable to review your transactions line by line at the end of each month to ensure every purchase is justified and necessary. Pay special attention to significant payments such as recurring services and insurance. If you believe you are overpaying for a service like health insurance, consider contacting the provider to explore more cost-effective options, especially during these challenging times.

Subscription services often rely on customers forgetting about their subscriptions to continue charging them. If you are not fully utilizing a subscription, it might be wise to cancel it and save some money each month. Additionally, try to minimize utility costs by unplugging unused electronics, regulating AC usage, and other energy-saving practices.

For those who are proactive, enrolling in cashback programs through your bank or apps can be beneficial. Purchasing specific brands or essential products could earn you modest cashback rewards. While these savings may seem small individually, they can accumulate over time. Ultimately, the goal is to eliminate unnecessary expenses and ensure you have the essentials like shelter, food, and reliable internet.