The popular money-sending app now comes with a credit card option in addition to its debit card.

Starting today, Venmo, the money-sending app, is rolling out its very own credit card to a selected group of customers in the United States. Customers who have had a Venmo account for at least 30 days and have been actively using it within the past year will be chosen at random to try out the card during its soft launch phase.

According to Darrell Esch, the Senior Vice President and General Manager at Venmo, “The card provides our customers with the familiar Venmo experience they enjoy, but in the form of an easy-to-use card with a rewards system that seamlessly integrates with the Venmo app.”

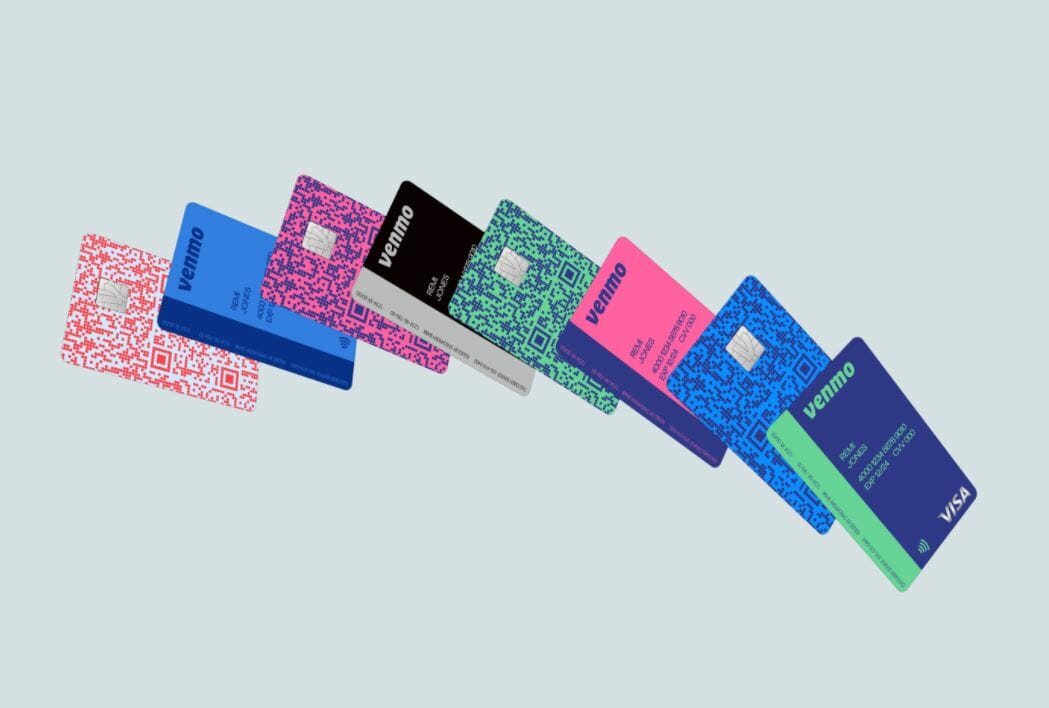

The physical card, which comes in five different colors, comes with a unique feature – a scannable QR code on the back. By scanning this code, users can send or receive money from their Venmo accounts, split payments, and use the card for tap payments thanks to the RFID chip it contains. Card settings can be easily managed using the Venmo app, and if the card is misplaced, it can be instantly frozen through the app, while still being usable for online transactions.

One of the card’s standout features is its customized cash-back rewards program. Unlike other credit cards that require users to choose a specific spending category for the highest cash-back rates, the Venmo card automatically adjusts rewards based on the user’s spending habits. Each month, purchases are categorized, and cash-back rewards are distributed accordingly. The category with the highest expenditure in a month earns 3% cash back, the second-highest earns 2%, and all other purchases earn 1%. This system ensures that users maximize their rewards without any extra effort.

Moreover, there is no annual fee associated with using the card. Upon approval, users will receive a temporary card number that can be used for purchases until the physical card is delivered to them.