Ensuring You Get Your Stimulus Check

The Internal Revenue Service (IRS) will kick off the distribution of stimulus payment checks to nearly all American citizens beginning this week. If your annual income is below $75,000, you are in line to receive $1,200. However, if you haven’t filed your taxes yet, it could pose a challenge, as the IRS reviews your eligibility based on your most recent tax return. If your circumstances have changed since your last filing, it’s crucial to act promptly.

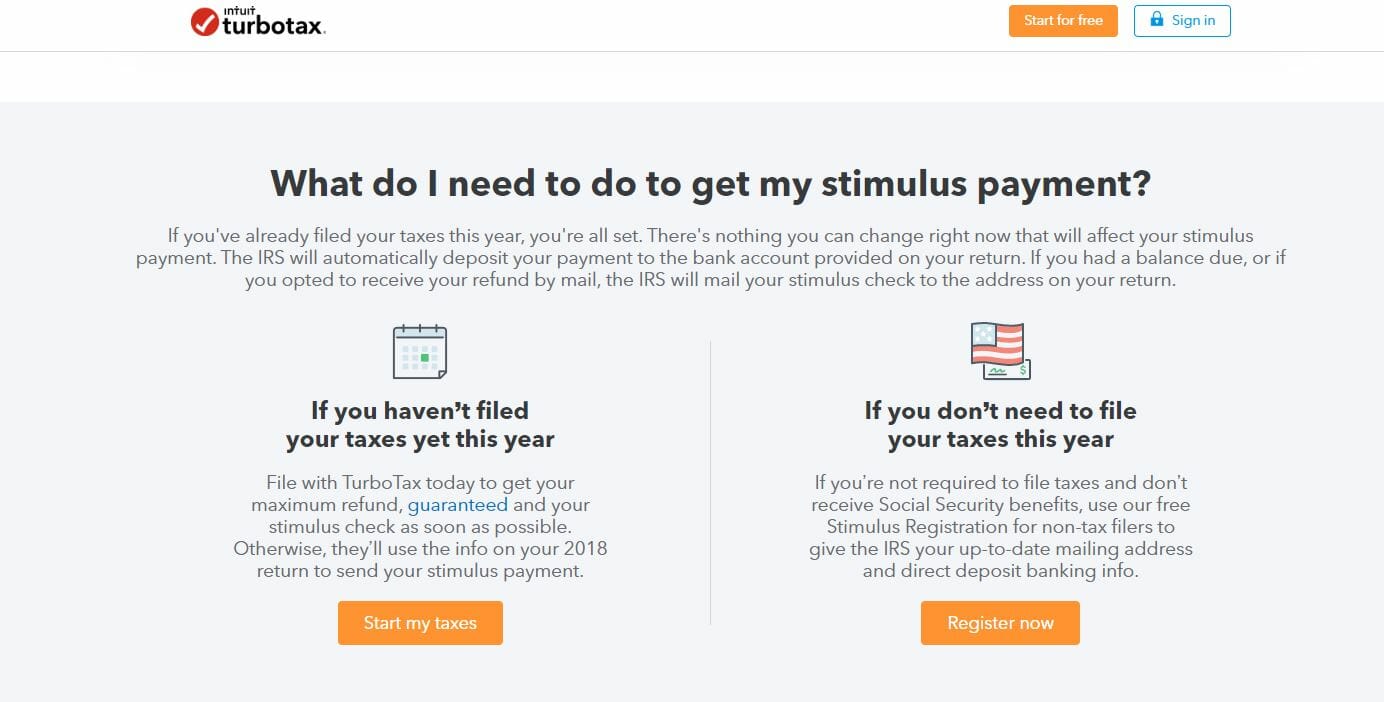

TurboTax, in partnership with the IRS, has launched a streamlined tax portal for individuals needing to file a quick return to qualify for the stimulus check. The portal includes a survey/calculator to determine your eligibility and the amount you may receive. It also offers convenient links to start your tax filing process swiftly or submit your current mailing address and direct deposit details to the IRS if you aren’t required to file a return.

If you’re new to TurboTax, fret not, as it’s user-friendly. Gather your W2s, pertinent housing, family, and income details, and follow the step-by-step instructions. In no time, you’ll be all set. It typically takes around thirty minutes, max an hour.

For those with direct deposit information on file with the IRS, the initial round of checks will be sent out this week, with funds expected to hit your account by Tuesday. Subsequent filings can anticipate receiving the stimulus money within one to two weeks. The IRS plans to mail a confirmation notice to recipients 15 days after sending out the check.