Either you drop them, or they’ll drop you.

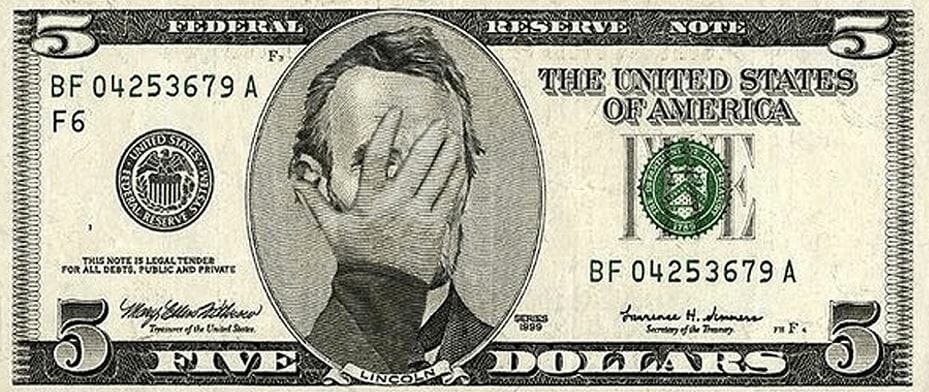

Everyone goes through a moment of realization when it comes to money, understanding its value in relation to their own well-being. For some, it’s a realization of responsible spending, while for others, it’s not so clear. If you fall into the latter group, chances are you have some unfavorable money habits that need to go before they lead you into financial trouble.

No Savings Account

Having a savings account is crucial. While it might seem convenient to keep all your money in one checking account, that money just sits there without growing. A high-yield savings account can help you save for the future or unexpected expenses. Even though there may be withdrawal fees, keeping both a savings and checking account can benefit you in the long run. By consistently putting money into your savings account, you can watch it grow over time.

Surprise Seasonal Expenses

Seasonal changes often come with additional expenses like summer cooling costs or winter heating bills. It’s important to adjust your budget accordingly and plan for these fluctuations. Keeping your finances flexible allows you to accommodate these seasonal expenses without causing financial strain.

Minimal Credit Card Payments

Paying just the minimum on your credit card may seem appealing, but it can lead to accumulating debt through interest charges. To avoid this, strive to pay off your credit card balance in full each month. Not only will this help you avoid interest fees, but it will also improve your credit score.

Unmatched 401(k)

Take advantage of any employer matching contributions to your 401(k) retirement savings plan. By contributing what your employer matches, you’re maximizing your savings potential. It’s a mutually beneficial arrangement that requires your active participation to reap the rewards.

No Budgeting

Creating a budget may seem daunting, but it’s essential for financial stability. Keeping track of your expenses ensures that you’re spending within your means and prioritizing essential expenses. Without a budget, you may find yourself overspending on trivial items and jeopardizing your financial security.