A recent report from financial research firm FSInsight suggests that Bitcoin could potentially hit $222,000, while Ether could reach $12,000 by the end of 2022.

Given the current prices of BTC at $43,350 and ETH at $3,080, this projection indicates a nearly five-fold and four-fold increase in value for each cryptocurrency, respectively.

The report titled Digital Assets In A Post-Cycle World outlines various factors that are expected to converge and propel these cryptocurrencies to these unprecedented heights by the close of the year. It points out that unlike previous cycles, BTC has not reached what the report refers to as “excessively inflated valuations.” This could be attributed to improved market efficiency or a shift from being a means of payment to a store of value.

The absence of bubble-like valuations is evidenced by the fact that since the May 2020 Bitcoin halving, the BTC market capitalization surged by just 3.7 times, marking the smallest increase since the 2016 halving that saw a peak of 4.2 times.

Halving refers to the reduction of the mining reward given per block by half, thereby decreasing the influx of new supply into the market. Following the 2020 halving, block rewards dropped to 6.25 BTC per block.

FSInsight also views the supply-side dynamics as a positive indicator, highlighting that approximately 75% of the circulating supply of Bitcoin consists of illiquid holdings that are held in long-term storage. The report depicts this scenario as a potential powder keg, waiting for a catalyst to set it off.

This assessment aligns with a video from the InvestAnswers Youtube channel on Feb 7, where host James Mullarney suggested that owing to the current scarcity of sellers, purchasing between 100,000 and 200,000 Bitcoin within a short span of one to two weeks could triple the price.

Furthermore, the report points out that the market value to realized value (MVRV) of BTC is at its lowest level since April 2020 when the price was still under $10,000. From that point, the price of BTC witnessed a steady climb, reaching a peak of around $57,000 in May 2021.

Ultimately, the report predicts that the price of BTC could reach a range of $138,000 to $222,000 by the conclusion of 2022.

The case for Ethereum

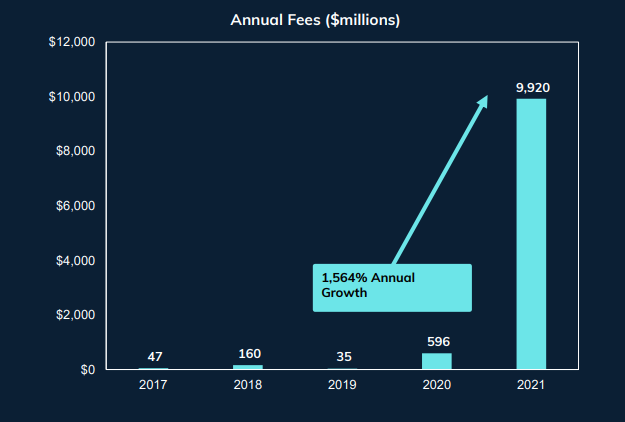

The optimistic outlook for ETH stems from Ethereum generating nearly $10 billion in fees during 2021, denoting a remarkable 1,564% annual growth rate from the previous year.

FSInsight analysts view the supply dynamics of ETH as positive, mentioning that the burn mechanism as part of EIP 1559 introduces “disinflationary pressure,” and though not attributing ETH as ‘sound’ money, it is deemed beneficial for its price.

Considering factors like The Merge, the shift of Ethereum to a Proof-of-Stake consensus, the development of Layer 2 platforms, and the potential introduction of Exchange Traded Funds (ETFs), analysts anticipate ETH price to reach $12,000 by the end of 2022, emphasizing that Ethereum is currently undervalued.