The price of palladium has surged again recently, following a consistent rise in value.

Over the last two weeks alone, palladium’s price has spiked by 25%. Currently priced at nearly $2550 per ounce, this precious metal has now surpassed the value of gold. The factors propelling palladium’s price upward show no signs of slowing down.

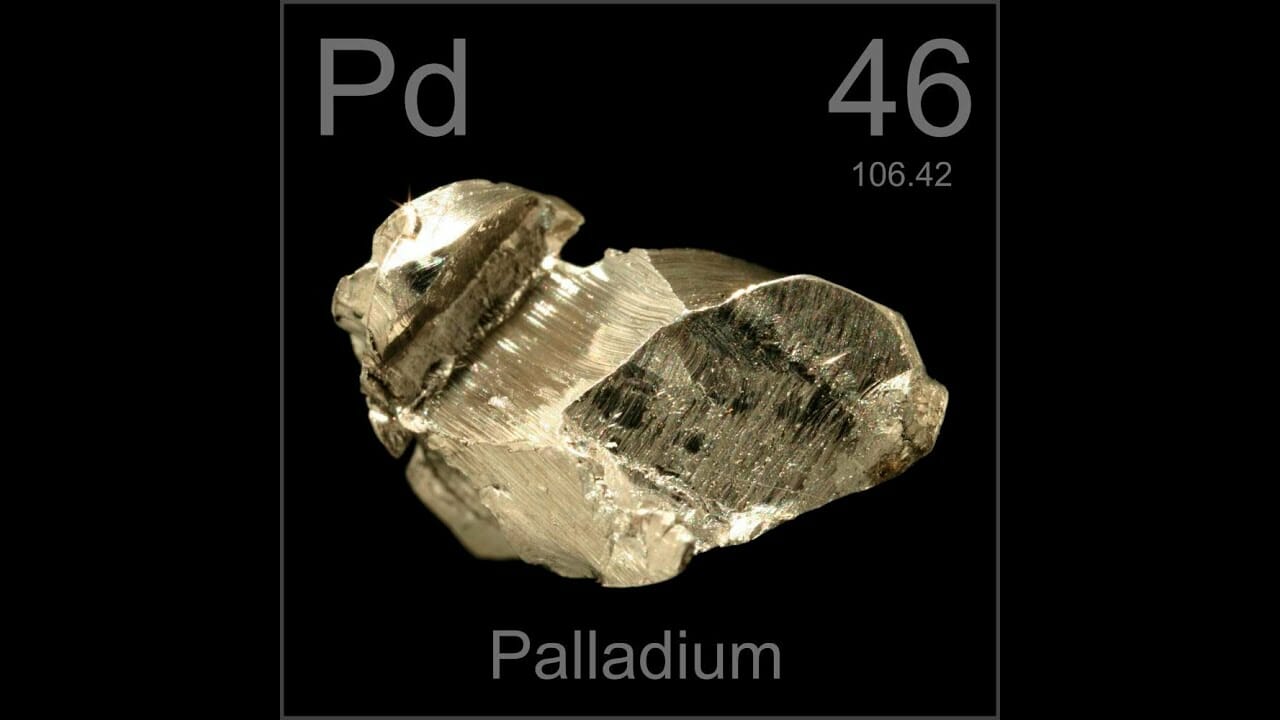

Palladium is a unique metal with diverse applications. It is commonly used in catalytic converters, which are essential components in car exhaust systems for regulating emissions. This metal plays a crucial role in most gas-powered and hybrid vehicles. The primary use of palladium is in catalytic converters, with approximately 80% of its usage directed towards this purpose. These converters work to convert harmful gases like carbon dioxide and nitrogen dioxide into less harmful substances such as nitrogen and water vapor. Additionally, due to its precious metal status, palladium can also be found in jewelry and electronics.

Currently, the demand for palladium surpasses the available supply, a trend that has persisted for the past eight years. This shortage is due to palladium not being the primary focus of any extraction process. The metal is a byproduct of platinum and nickel extraction, limiting miners’ ability to ramp up palladium production in response to increased demand. Moreover, palladium is predominantly sourced from a few regions, notably South Africa, which accounts for 40% of production, and Russia.

As global regulations on vehicle emissions become stricter, the demand for palladium is expected to rise further. Given its scarcity and limited availability, the cost of palladium is likely to remain high in the foreseeable future.