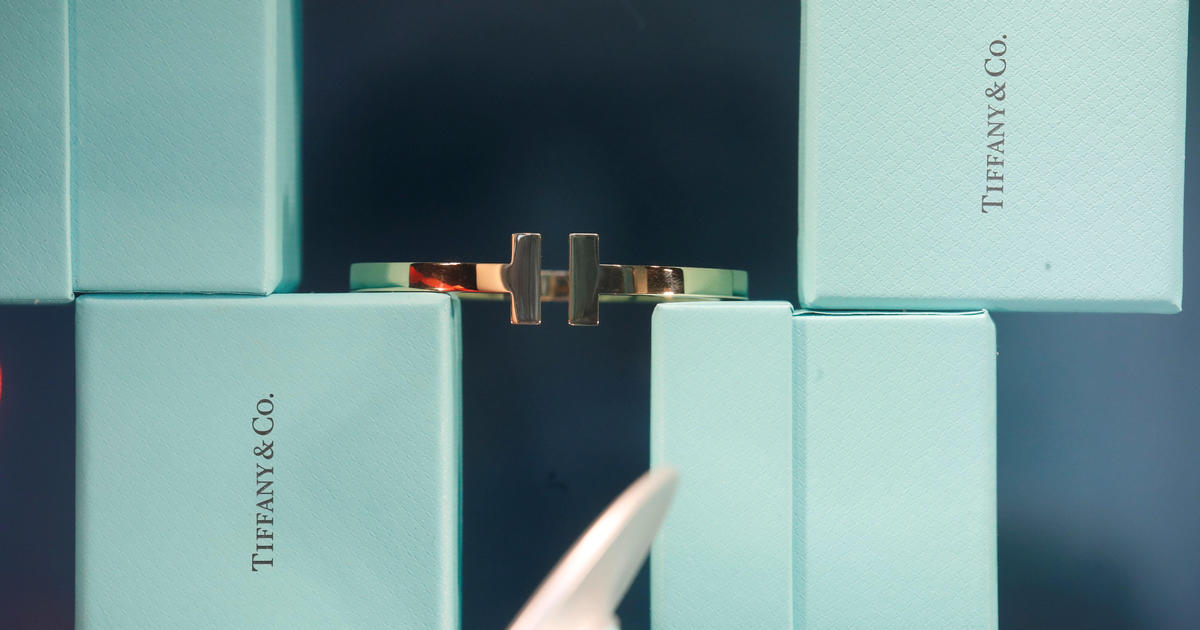

LVMH, the world’s leading luxury goods company, is set to purchase Tiffany & Co. in a deal worth $16.2 billion

LVMH aims to revitalize Tiffany & Co. and boost its jewelry and watch division, which is currently one of its smallest segments. This acquisition marks a significant move for LVMH and solidifies its position as a powerhouse in the luxury goods market. The purchase price of $135 per share highlights the scale of this acquisition, further enhancing LVMH’s dominance in the industry. The company, led by Bernard Arnault, the richest man in France, is already a key player in the luxury goods sector.

With the jewelry industry on the rise, LVMH anticipates that acquiring Tiffany will strengthen its foothold in the jewelry market and expand its presence in the United States. Both LVMH and Tiffany issued a joint statement expressing their optimism about the deal. The announcement was well received by the markets, leading to a 1.8% increase in LVMH shares and a 6.6% rise in Tiffany’s shares on Monday.

The agreement between LVMH and Tiffany came together swiftly, with just a five-week period from LVMH’s initial offer of $120 per share to the final deal. The companies are targeting a summer 2020 closing date for the acquisition, with Tiffany’s board of directors already voicing their support for the transaction. Given the mutual agreement and excitement surrounding the deal, it is expected to face minimal obstacles during the approval process.