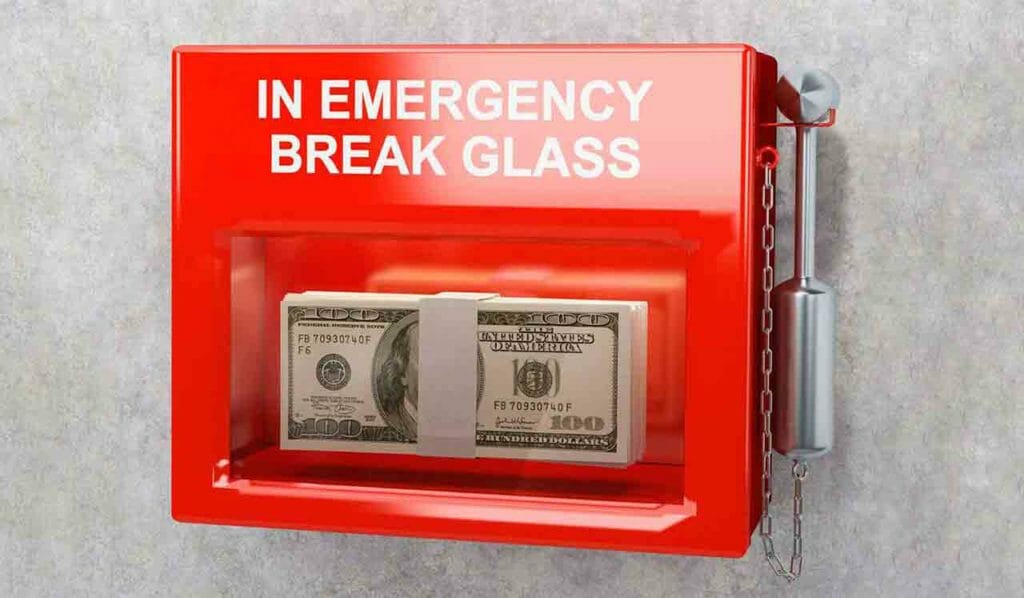

Being Prepared for Unexpected Expenses

Life can be full of surprises, some of which can be costly. Whether it’s an unforeseen accident or a sudden financial setback, having funds set aside for emergencies is crucial. It’s essential to have a safety net to rely on when the unexpected strikes.

An emergency fund provides a financial cushion that allows you to handle unexpected expenses without disrupting your regular income or resorting to loans. Surprisingly, a large number of Americans do not have an emergency fund, as highlighted by Charles Schwab’s 2019 Modern Wealth survey, where 62% of respondents reported lacking this crucial financial resource.

The challenge lies in building an emergency fund. It involves saving money consistently, which can be a tough task for many. Depending on your circumstances, you may need to make certain lifestyle adjustments to prioritize saving. This may involve cutting back on unnecessary expenses, opting for more budget-friendly options, and curbing impulse spending.

Even if initially challenging, establishing an emergency fund, even with a few hundred or a couple of thousand dollars, can provide a sense of security and peace of mind. By reevaluating your spending habits and making necessary sacrifices, you may discover areas where you can permanently reduce expenses, allowing you to continue building your emergency fund over time.

Having an emergency fund in place is a wise financial strategy that can help you navigate unexpected events without financially derailing yourself. Don’t wait until a crisis occurs to realize the importance of being financially prepared for life’s uncertainties.