CVS shares have shot up as the company’s second quarter earnings beat expectations.

Shares were up 5.6% Wednesday morning as the company beat Q2 expectations. CVS has managed to exceed earnings expectations while the company continues with the integration of Aetna, a health insurance company. Furthermore, the company followed up by increasing their full-year profit guidance for 2019 once again.

The report released by CVS came with an assurance to investors that the company is financially stable following their acquisition of Aetna for $70 billion in November of 2018. In the report CVS CEO Larry Merlo explains “While still early, we remain confident that we will be able to realize the potential of our innovative and powerful new business model to deliver enhanced value to our clients and the customers we serve.”

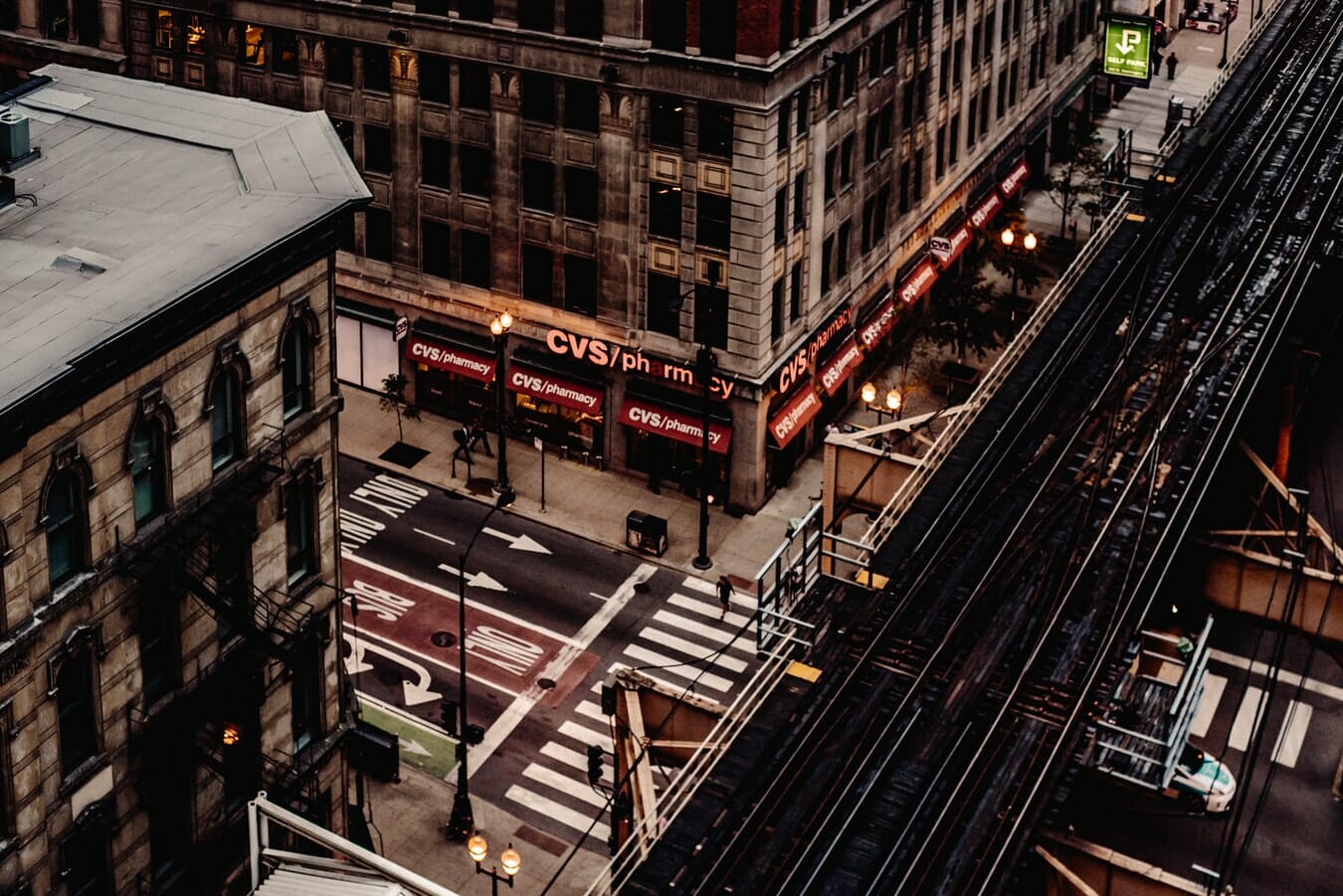

CVS closed on Tuesday at $54.09 per share, a 17% decrease for the year-to-date. While the company hasn’t been doing brilliantly recently, there are some ambitious projects underway. CVS plans to open 1500 locations for its new HealthHUB project by the end of 2021. About 50 of these stores are expected to be opened by the end of the year. The HealthHUB locations are coming as a part of Aetna’s integration with the pharmaceutical giant. The first three HealthHUB stores already opened up in Houston earlier this year.