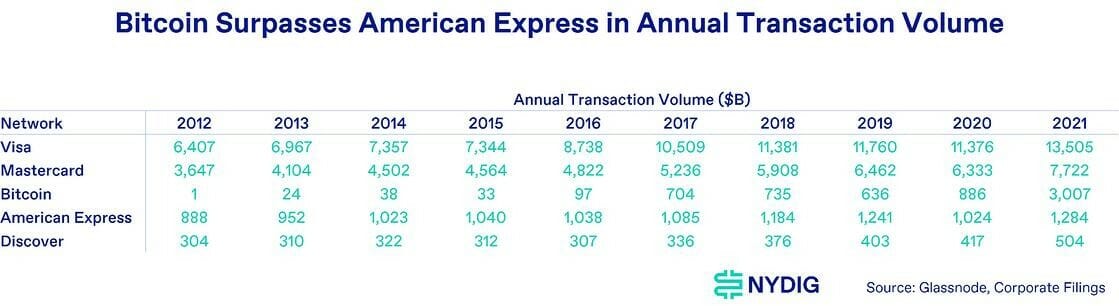

A recent study discovered that the yearly transaction volume on the Bitcoin network exceeded that of well-known card networks like American Express (AmEx) and Discover in 2021.

The analysis in NYDIG Research Weekly’s report on Jan. 29 revealed that Bitcoin handled $3 trillion in payments during 2021, surpassing the transaction volumes of popular credit card networks American Express ($1.3 trillion) and Discover ($0.5 trillion).

The authors of the report, NYDIG’s Global Head of Research Greg Cipolaro and Research Analyst Ethan Kochav, also observed that the Bitcoin network settled more transaction volume in Q1 2021 compared to “all credit card networks combined for the entire year.”

They expressed their astonishment at this growth, considering that Bitcoin is just 13 years old, while American Express issued its first card in 1958 and Discover in 1985.

Despite this achievement, the Bitcoin network still has a significant gap to bridge to reach Visa and Mastercard, which processed $13.5 trillion and $7.7 trillion in transactions, respectively.

It’s important to note that the study focused on the $USD value of transaction volume rather than the number of transactions. Hence, most BTC transactions likely involved users buying, exchanging, and selling BTC rather than using it for payments.

Although Bitcoin’s transaction volume growth hasn’t been consistent annually, Cipolaro and Kochav noted that it has maintained a rapid pace when examining 5-year compound annual growth rates.

“By the end of 2021, transaction volumes have been increasing by nearly 100% each year over the past 5 years.”

In November 2021, a Blockdata study projected that the Bitcoin network could potentially match the value transferred on Mastercard’s network by 2026. Additionally, it highlighted that the Bitcoin network already surpasses PayPal in transaction volume by dollar value.

According to the report, the Bitcoin network processed approximately $489 billion per quarter in 2021, exceeding PayPal’s $302 billion.

Related: Bitcoin surpasses PayPal in transferred value, eyes Mastercard next: Report

The measure of Bitcoin transaction volumes does not solely indicate the raw volume of on-chain transactions but also considers statistical analyses by data providers like Glassnode to exclude transactions without economic significance.

The report incorporates “intra-entity transactions,” which involve transactions between addresses within the same wallet or owned by the same entity. For instance, this could involve a crypto exchange frequently moving Bitcoin across various addresses. Therefore, the $3 trillion figure may need to be viewed with caution.