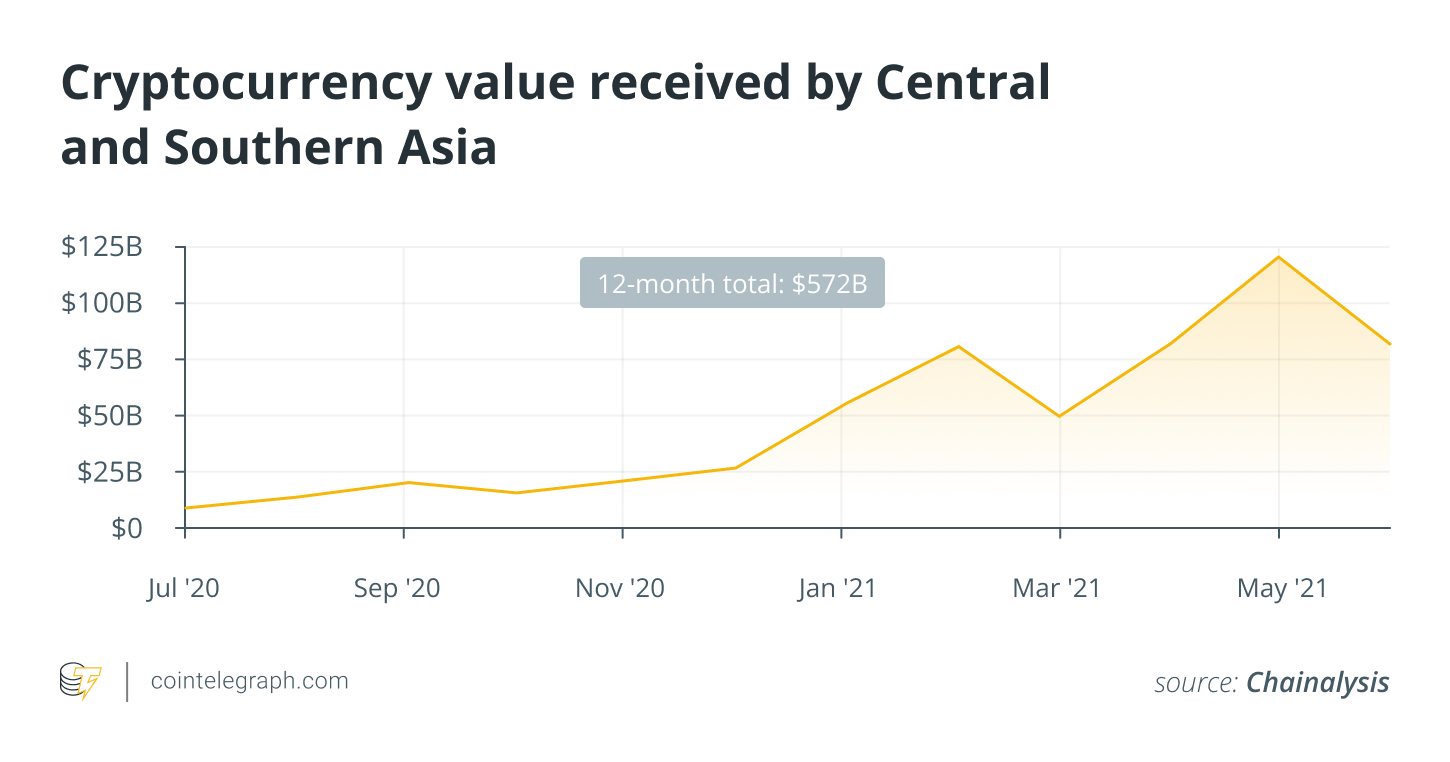

Cryptocurrency, known for transcending boundaries, is finding Asian markets particularly influential in its growth and evolution. Asia has been a significant destination for crypto transactions, with Chainanalysis reporting that 28% of global cryptocurrency transactions, totaling $1.16 trillion, took place in the region during the first half of 2021. Central and Southern Asia have experienced a remarkable 706% year-over-year growth in crypto transactions, making it one of the world’s fastest-growing regions.

Although China dominated headlines in the past concerning cryptocurrency regulations, developments in other Asian countries have been notable. Singapore, with its clear regulatory framework around digital assets, has seen a surge in decentralized finance (DeFi) innovation and investments. As confidence in DeFi opportunities grows among investors, institutional adoption in the region is poised for further expansion in 2022.

A new chapter, without China

China’s regulatory stance on cryptocurrency, driven by its capital control policies, has prompted a swift adaptation by industry players. Miners have relocated to Kazakhstan and the United States, while exchanges and traders have found new homes in Singapore and Hong Kong. The decentralized nature of crypto allows for the development and innovation to flourish in jurisdictions that foster such activities through supportive regulatory frameworks and progressive immigration policies.

Singapore stands out in this regard, boasting a well-established financial ecosystem and pro-business environment. While meeting the stringent regulatory requirements set by the Monetary Authority of Singapore might be challenging for some, the country remains a leader in progressive regulatory frameworks, offering stability and favorable conditions for crypto development.

Asia’s other crypto rising stars

Thailand has seen increased participation from both startups and traditional financial institutions in the crypto space. Major banks in Thailand, such as Kasikornbank and Siam Commercial Bank, have ventured into DeFi and digital asset exchanges. Meanwhile, the Tourism Authority of Thailand is exploring utility tokens for cashless transactions. The country’s central bank is set to introduce comprehensive rules for digital assets in early 2022, balancing risk mitigation with fostering innovation.

Indonesia, with a large unbanked population, has witnessed a surge in crypto transactions and trading activity. The country’s authorities have shown mixed signals, banning crypto payments but legalizing trading and exploring the possibility of a national digital rupiah. As Southeast Asia’s largest economy, Indonesia presents significant opportunities for crypto development and partnerships with global entities.

Momentum into 2022: Increased funding spurs innovation

The popularity of crypto has attracted not only retail traders but also institutional investors seeking promising growth opportunities. Asia has seen significant involvement from institutional investors in crypto transactions. Traditional asset managers are exploring ways to capitalize on crypto, with investments being made in crypto operators and asset management platforms to cater to a diverse range of users.

Old money flowing into new

Asian conglomerates are expected to invest more in crypto projects as they embrace digital assets for future growth. The region also presents opportunities for innovation to serve the underbanked population, with DeFi services expected to cater to their needs. Increased funding will drive further innovation and adoption of crypto in Asia, creating value across the region.

This article does not contain investment advice or recommendations. Readers should conduct their own research before making investment decisions, as every investment involves risks.

The views expressed by the author do not necessarily reflect those of Cointelegraph.

Cynthia Wu is the founding partner and head of business development and sales at Matrixport. With a background in investments, blockchain technologies, and financial derivatives, she brings valuable insights into the evolving crypto landscape.