El Salvador’s Bitcoin Law: Exploring Options Beyond Government Involvement

Last year, El Salvador made history by becoming the first country to recognize Bitcoin as an official form of currency. This decision has stirred both praise and criticism, with supporters hailing the potential for wider financial inclusion among the unbanked population and detractors questioning the top-down enforcement of the law. While some Salvadorans feel constrained by this governmental mandate despite the organic adoption of Bitcoin in places like El Zonte before the law came into effect.

This debate on the Bitcoin law doesn’t necessarily pit one side against the other. Even though the government initiated this move, it has opened up financial opportunities for previously underserved segments of the population. However, not every government is keen on embracing Bitcoin as legal tender. This raises the question of how to promote cryptocurrency adoption in emerging markets like El Salvador without relying on government intervention.

Banking the Unbanked in Latin America

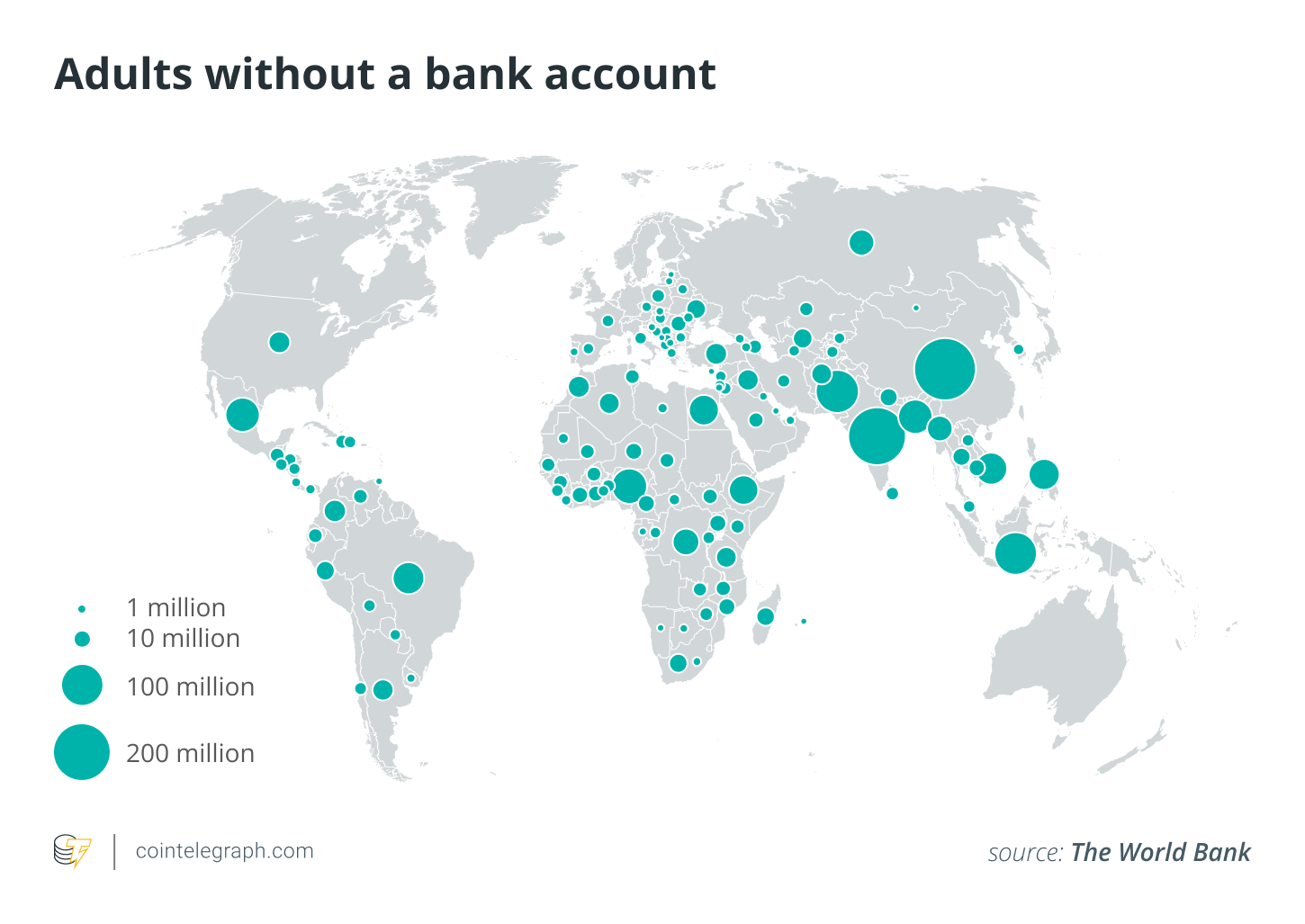

Recent reports by the World Bank revealed that nearly half of the Latin American and Caribbean population did not have access to traditional banking services. Factors such as account maintenance costs, lack of documentation, geographical distance from financial institutions, and trust issues were cited as key reasons for remaining unbanked.

The challenges of being unbanked are significant, limiting individuals’ ability to receive payments securely, save money, transfer funds, access credit, and build credit histories. Cryptocurrencies are beginning to address these challenges by providing online financial services like savings accounts, lending platforms, and micro-insurance solutions via mobile devices at lower costs and with greater accessibility than conventional banks. The appeal of cryptocurrencies like Bitcoin lies in their ease of access, affordability, and anonymity, making them an attractive option for financial inclusion in countries like El Salvador.

Understanding Government Involvement

While widespread adoption of cryptocurrencies could offer significant benefits to unbanked populations, the method of implementation is crucial. El Salvador’s decision to mandate Bitcoin as legal tender is part of a broader strategy to lift the country out of poverty. By investing national reserves in Bitcoin, the government aims to harness the potential earnings and fulfill its commitments to enhancing public infrastructure such as schools and public amenities across the nation.

Reimagining Mainstream Adoption

Although El Salvador opted for direct government intervention, there are alternative pathways to encourage widespread cryptocurrency adoption without heavy reliance on state mandates. Five key considerations for fostering mainstream adoption include mobile accessibility, education, financial inclusion, institutional acceptance, and exploring diverse cryptocurrency options beyond Bitcoin.

Promoting Mobile Accessibility

To facilitate mass cryptocurrency adoption, financial technology firms must develop mobile-friendly solutions tailored to users in regions like Latin America and the Caribbean, where fixed broadband connectivity remains limited. By offering financial services through mobile platforms, fintech companies can expand access to underserved populations and make engagement with cryptocurrencies more convenient and intuitive.

Providing Educational Programs

In addition to mobile accessibility, education plays a vital role in fostering trust and understanding of cryptocurrencies. Transparent educational initiatives can demystify cryptocurrency concepts and showcase their benefits to users. Incentivized learning programs, such as those offered by platforms like Rabbithole, can further enhance understanding and encourage community participation in decentralized applications.

Breaking Financial Barriers

Access to basic funds is essential for individuals to begin using digital currency services. Universal basic income initiatives, such as ImpactMarket’s decentralized poverty alleviation protocol, provide a foundation for encouraging adoption by distributing digital assets to communities in need. By incorporating funds distribution into mobile-friendly educational platforms, users can embrace cryptocurrencies voluntarily and gradually.

Encouraging Institutional Adoption

Apart from individual users, institutional adoption of cryptocurrencies is crucial for driving broader acceptance and usage of digital assets in everyday transactions. Organizations like CARE and the Grameen Foundation are integrating blockchain technology into their operations to deliver aid and support vulnerable populations in countries like Ecuador and the Philippines. Such initiatives not only promote trust in cryptocurrencies but also extend financial opportunities to marginalized groups.

Diversifying Beyond Bitcoin

While El Salvador’s adoption of Bitcoin has garnered attention, the cryptocurrency landscape offers a range of alternatives that may better suit the needs of unbanked individuals worldwide. Some cryptocurrencies boast lower transaction fees and reduced environmental impact compared to Bitcoin, with stablecoins offering a less volatile choice for financial transactions.

In conclusion, the evolution of cryptocurrencies presents a unique opportunity to enhance financial inclusion and empower underserved communities. By focusing on mobile accessibility, education, financial empowerment, institutional adoption, and exploring various cryptocurrency options, we can advance the adoption of digital assets in emerging markets like El Salvador without solely relying on government mandates.A range of digital currencies and stablecoins offer various advantages such as quick transactions, minimal transaction fees, and price stability. These could be combined to provide people with more accessible and cost-effective financial services.

Some countries like El Salvador have embraced Bitcoin as a legal tender, recognizing the potential benefits for their citizens. However, not all countries may follow suit. Fintech companies looking to enter markets in Latin America and other regions should consider different approaches to promote the adoption of cryptocurrencies, such as mobile accessibility, education, funding access, institutional acceptance, and alternative digital currencies, to encourage widespread adoption without relying on government mandates.

It is crucial to localize strategies to cater to the specific needs of smaller communities worldwide. By addressing these five key aspects, individuals can gain access to digital currencies and financial technologies that suit their unique requirements.

This article was collaboratively written by Xochitl Cazador and Angélica Valle.

Disclaimer: This article does not provide investment advice. Readers should conduct their own research before making any financial decisions. The views expressed here are solely those of the authors and may not necessarily reflect the opinions of Cointelegraph.

Xochitl Cazador is responsible for platform and builder growth at Celo Foundation, with a background in strategy execution and operational scaling. Angélica Valle, the ecosystem lead for Mexico at Celo Foundation, brings over four years of experience in Mexico’s blockchain sector and has a background in public policy, social entrepreneurship, and innovation.